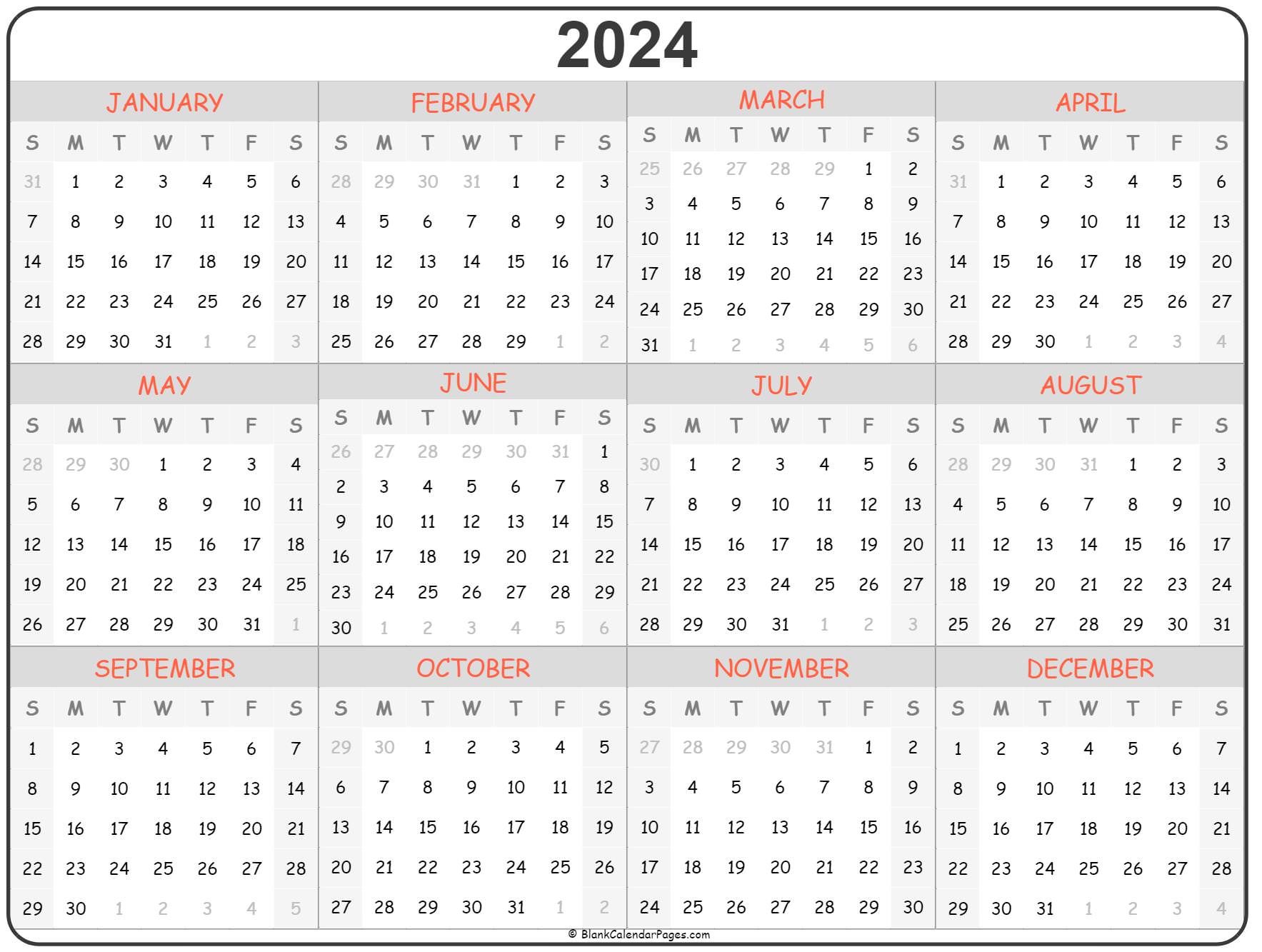

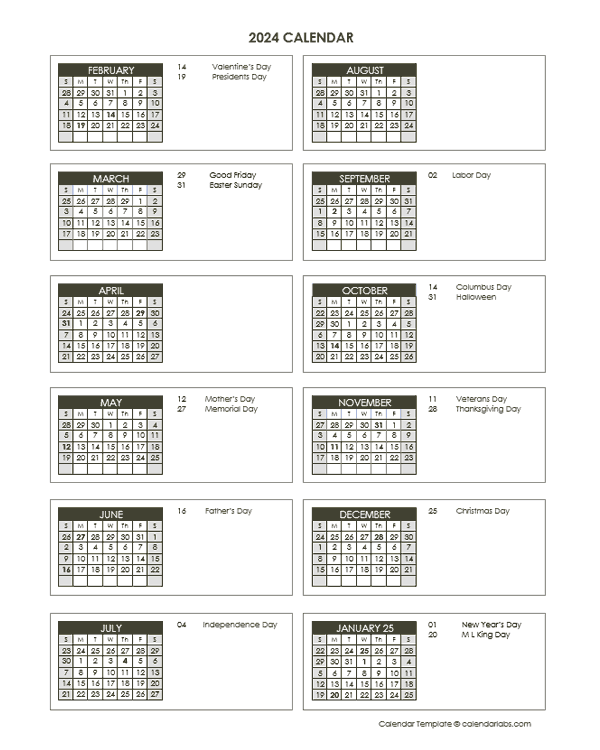

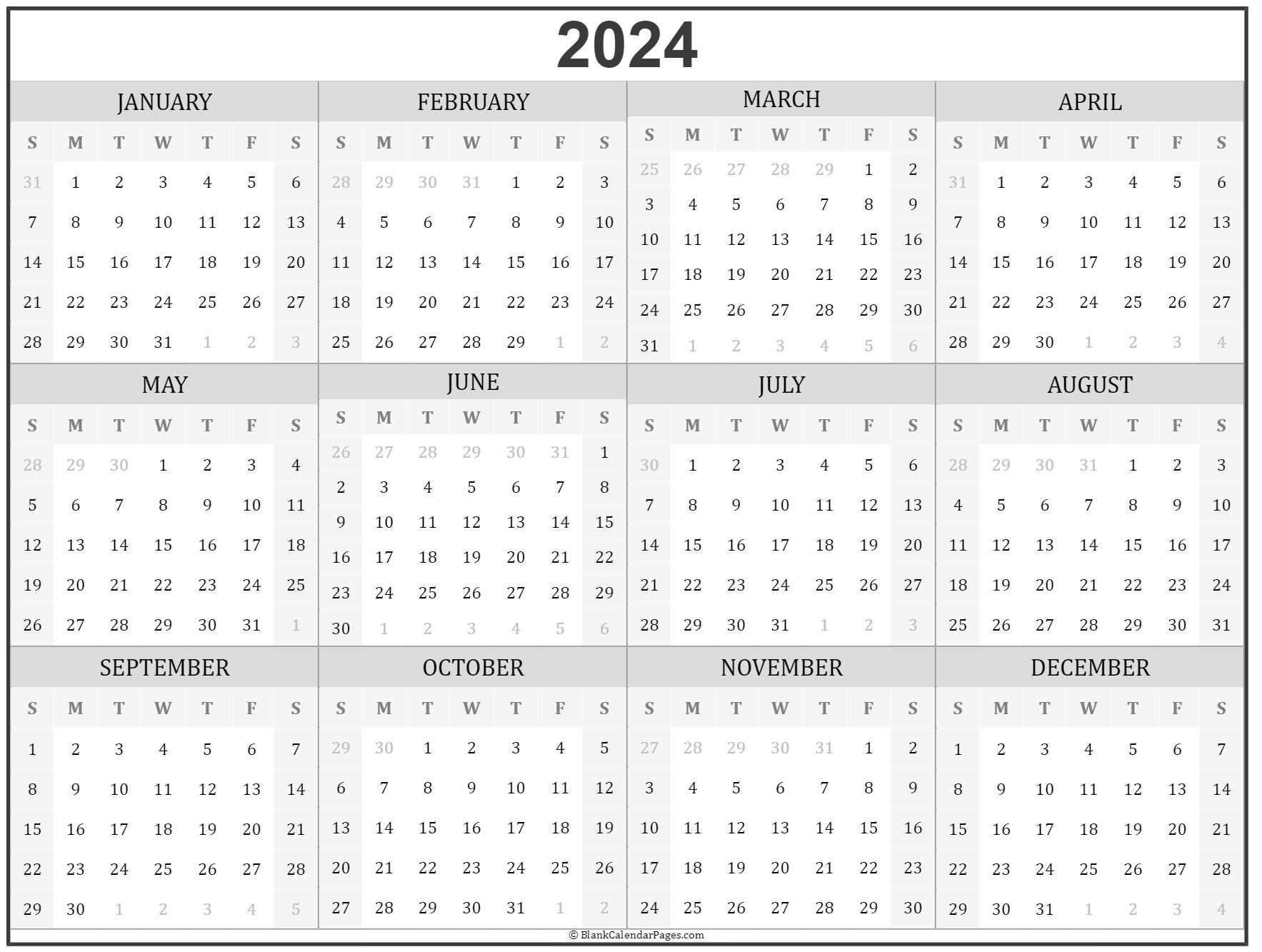

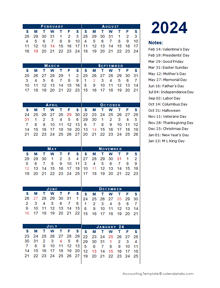

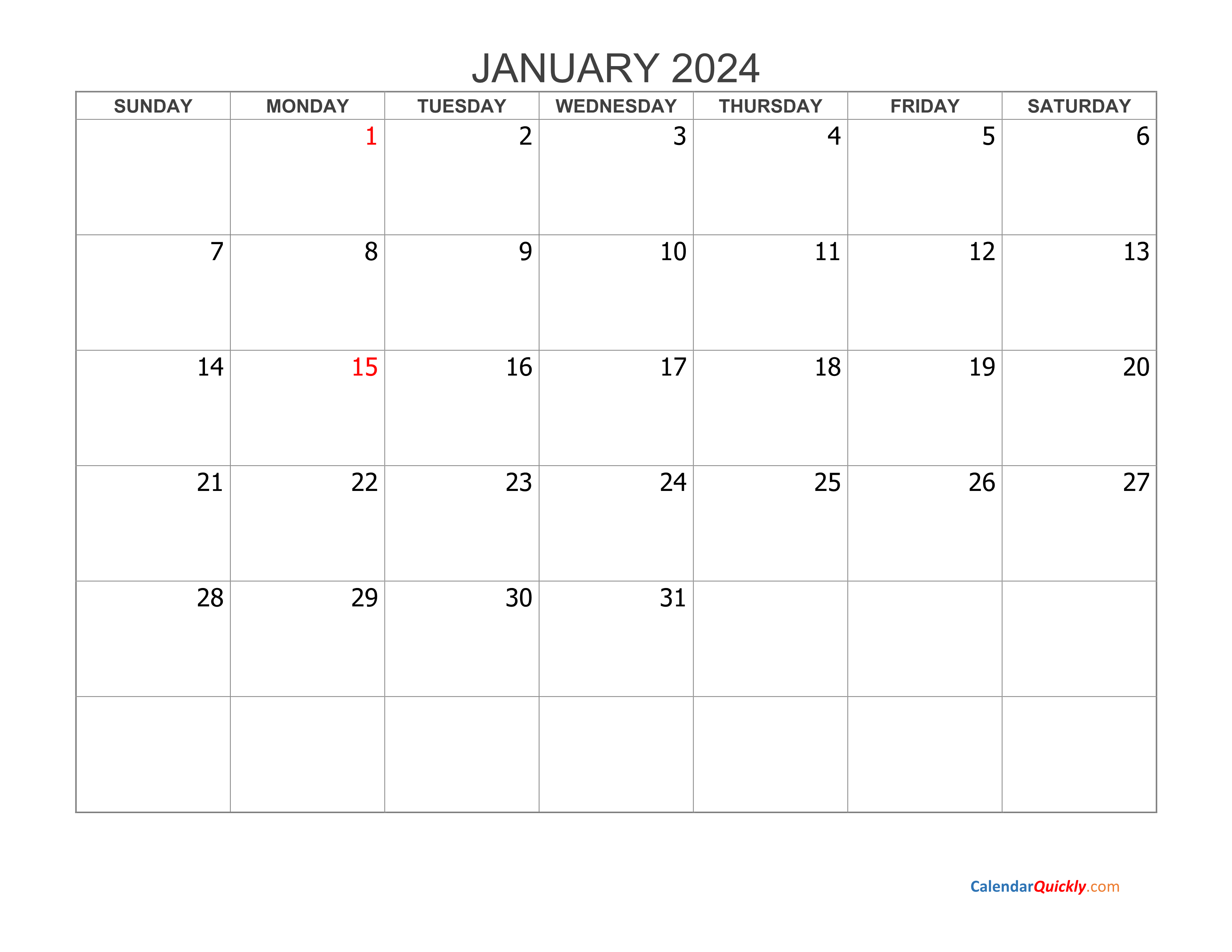

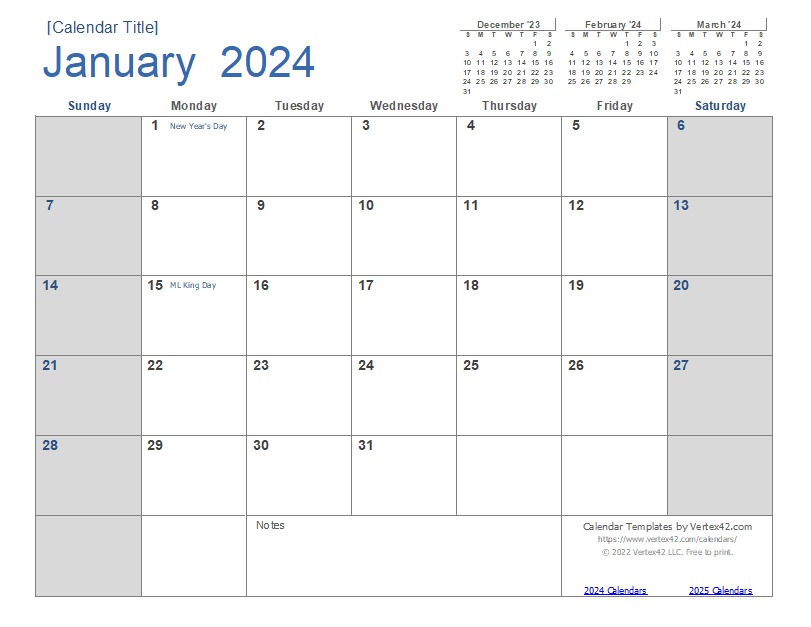

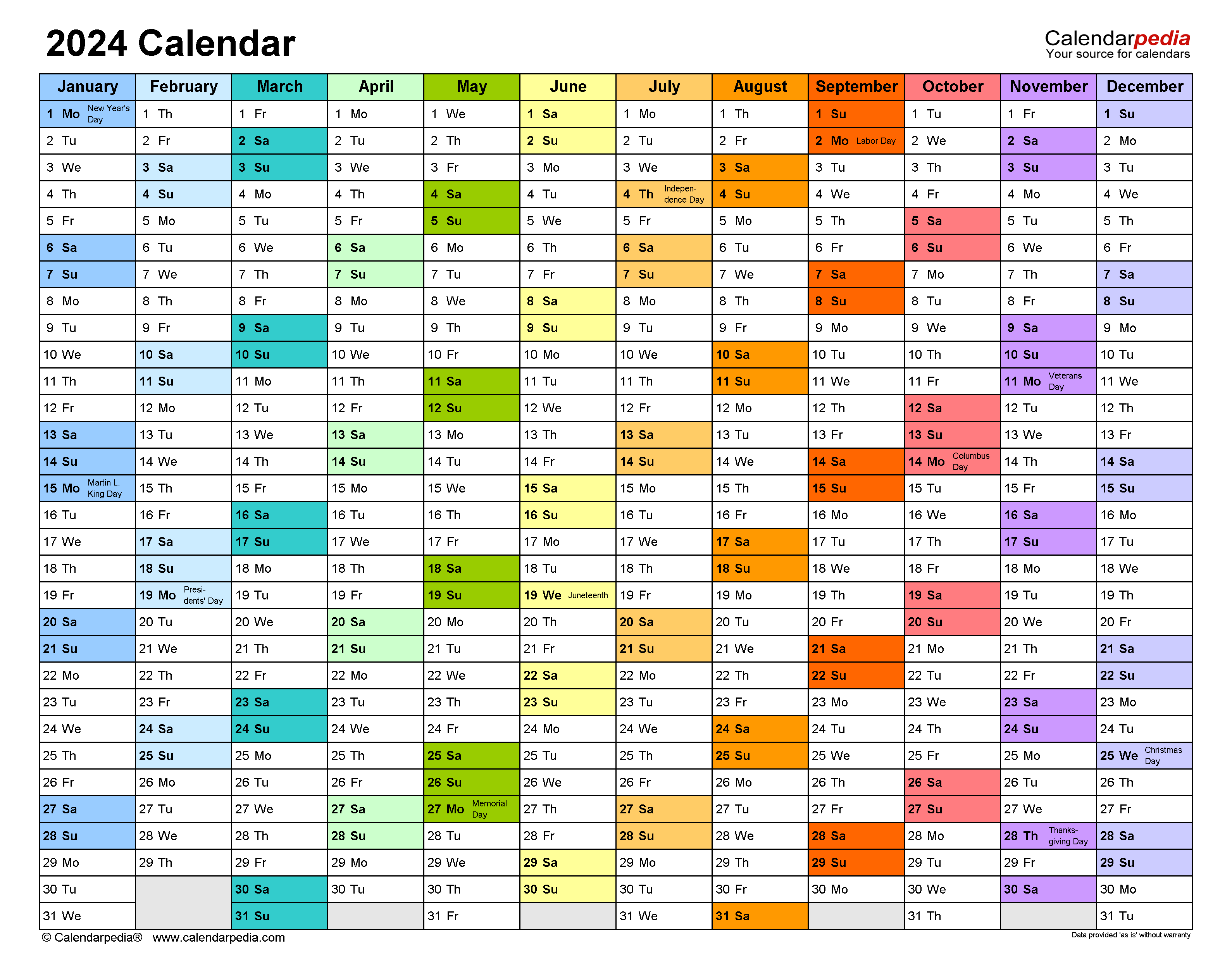

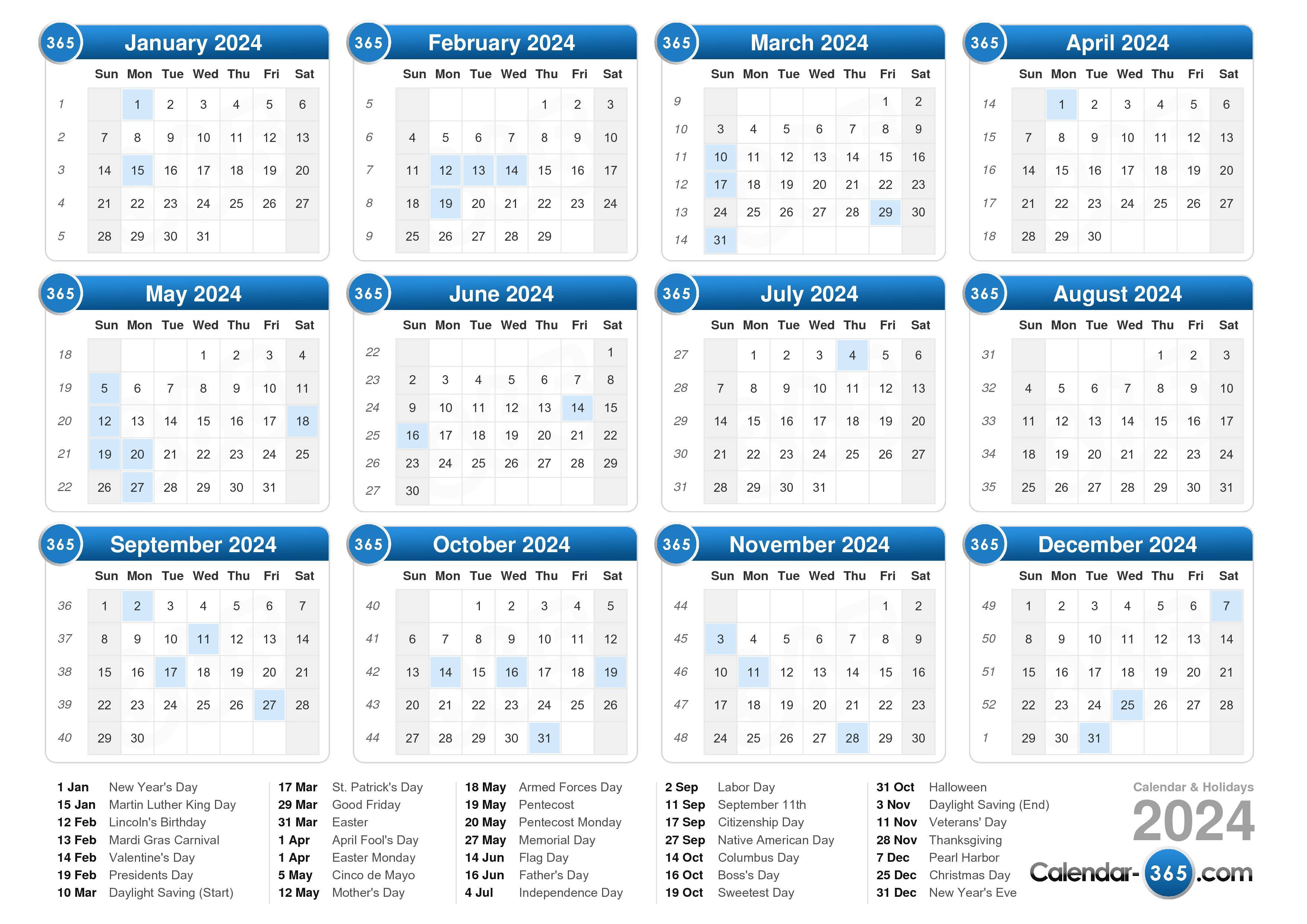

Calendar Year Accounting 2024. An annual accounting period does not include a short tax year. The fiscal period's months are arranged vertically into quarters. The standard calendar quarters that make up the year are as follows: January, February, and March. Here's what you need to know: The tour. Expert Answer Transcribed image text: Ashley Bakery uses the modified half-month convention to calculate depreciation expense in the year an asset is purchased or sold. For the fiscal calendar, the template includes quarter markings. Optionally with marked federal holidays and major observances. It includes the UK public holidays and week numbers.

Calendar Year Accounting 2024. Optionally with marked federal holidays and major observances. Here's what you need to know: The tour. A fiscal year is also known as a financial year. The standard calendar quarters that make up the year are as follows: January, February, and March. It includes the UK public holidays and week numbers. Calendar Year Accounting 2024.

Additional Days School Year adds half-day formula funding for school systems that add instructional days to any of their elementary schools.

A fiscal year is also known as a financial year.

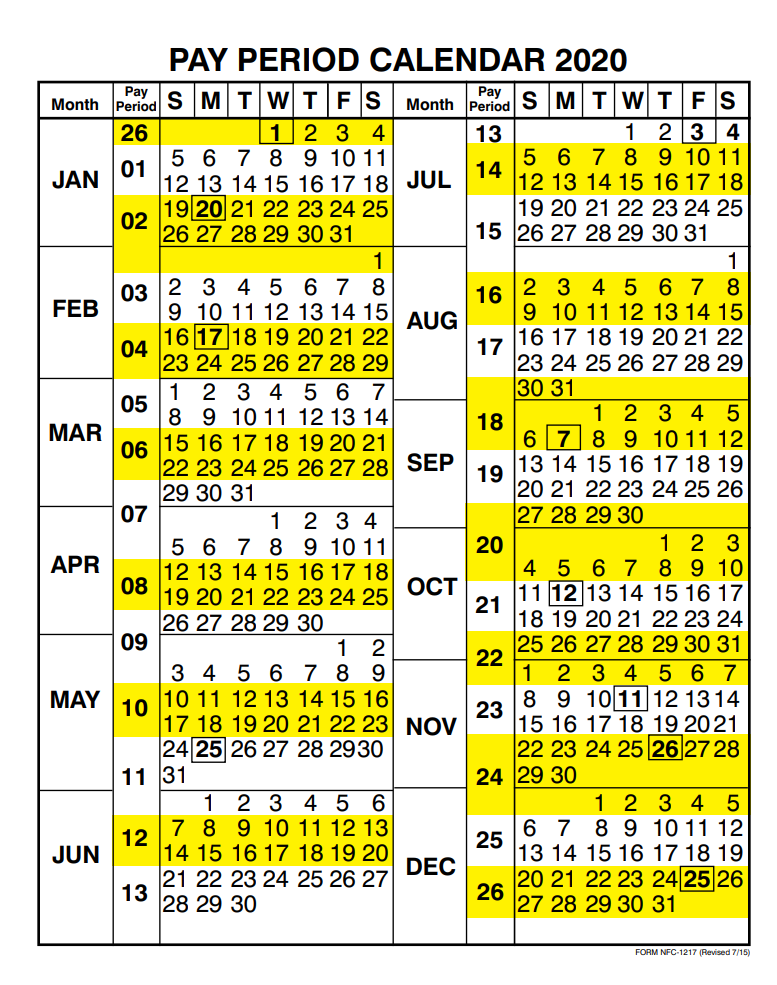

Calendar Year Accounting 2024. HR Back Office Publications You are currently in this section NFC University I Want to. An annual accounting period does not include a short tax year. It includes the UK public holidays and week numbers. The standard calendar quarters that make up the year are as follows: January, February, and March. Ashley has a calendar year accounting period and uses the double – declining – balance method to compute depreciation expense.

Calendar Year Accounting 2024.