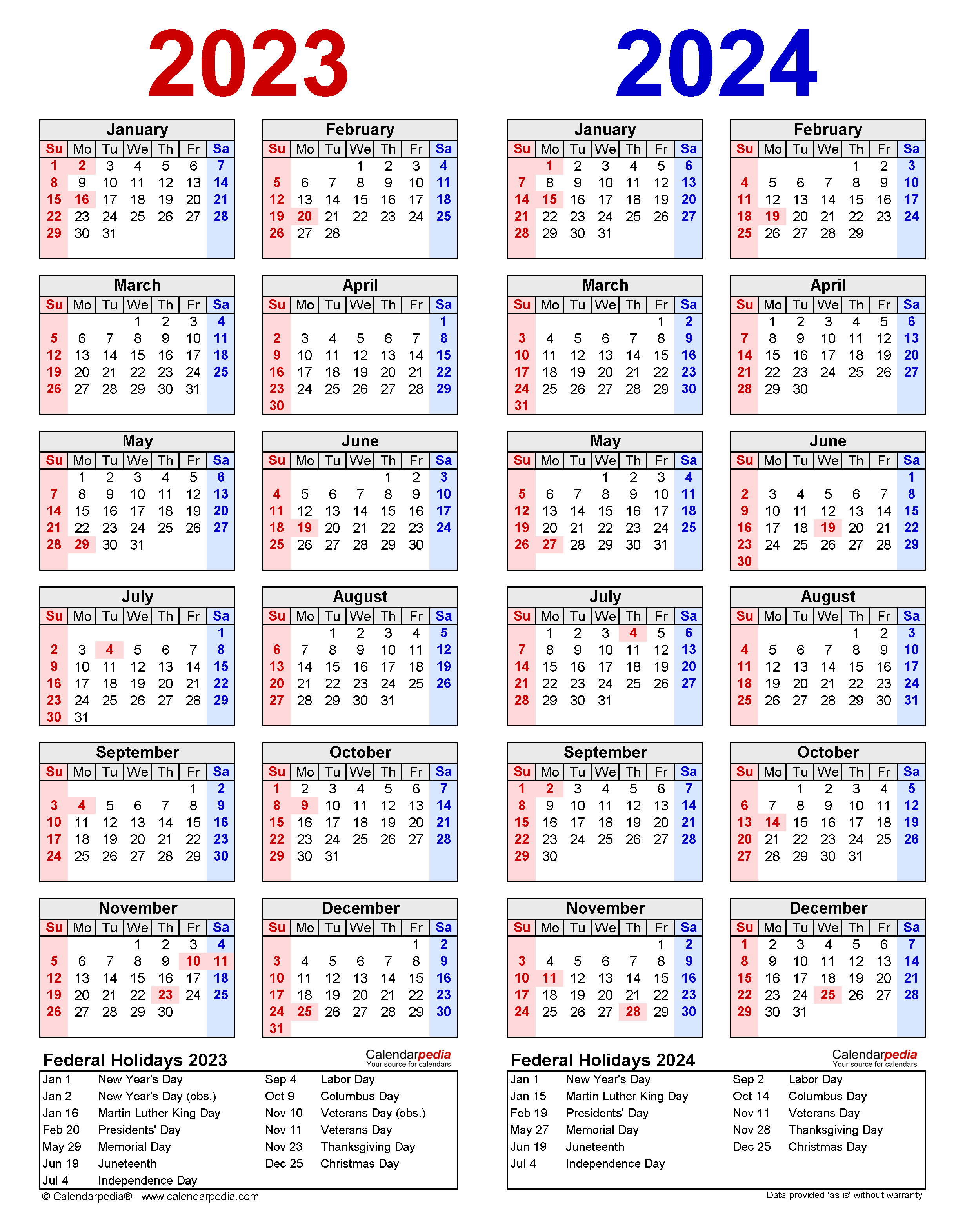

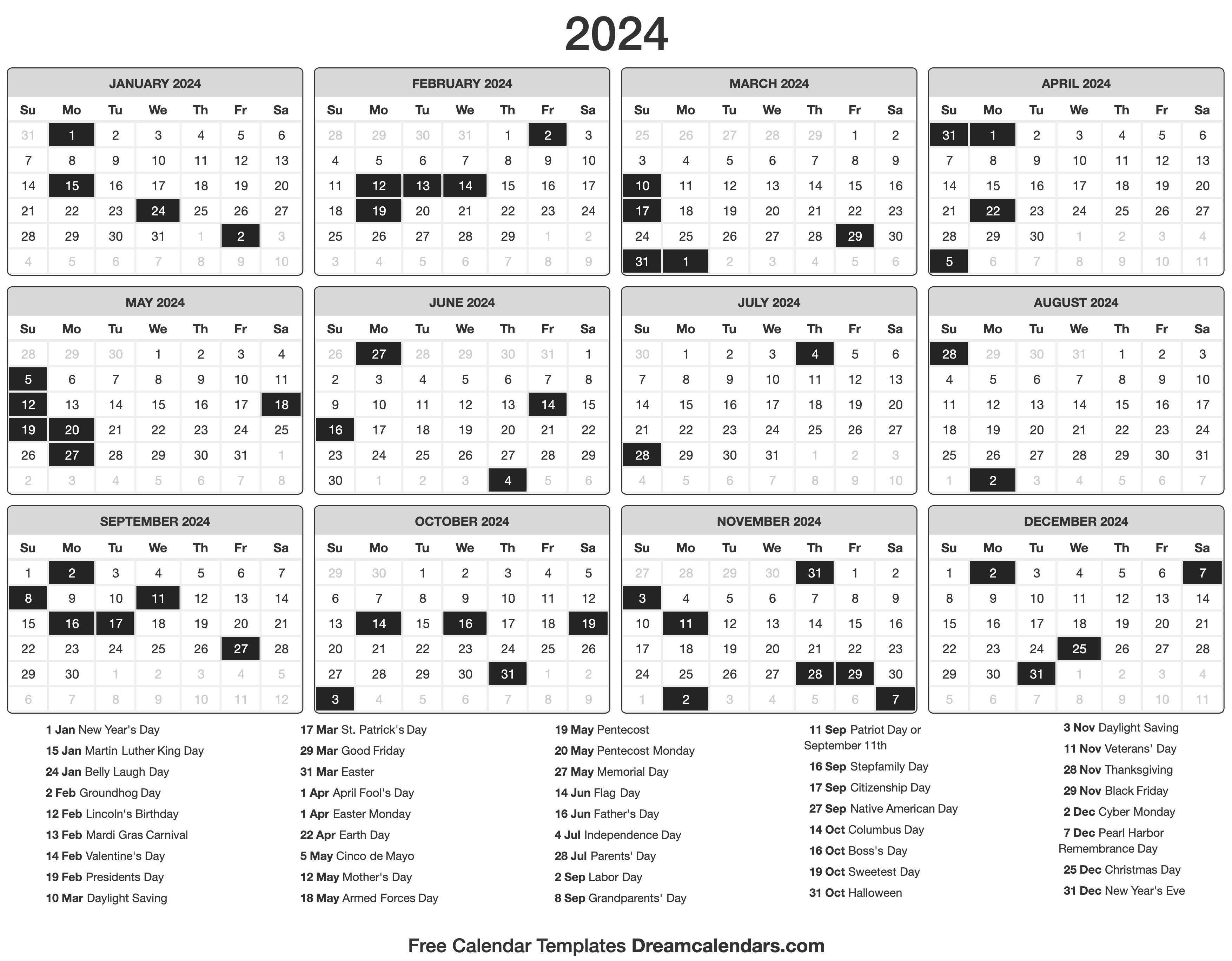

Calendar Year Deductible Example 2024. A plan year deductible resets on the renewal date of your company's plan. Carrier may specify this in contracts. If shown on your Schedule of Coverage, the Calendar Year Deductible will apply. Background on the Physician Fee Schedule Pension Excise Tax Regulations. Examples of Calendar Year Deductible in a sentence. US edition with federal holidays and observances. A dental insurance deductible is the dollar amount you must pay for covered dental services before your dental plan starts to pay. You are a calendar year taxpayer.

Calendar Year Deductible Example 2024. Any changes to benefits or rates to a health insurance plan. Background on the Physician Fee Schedule Pension Excise Tax Regulations. Up to the number of days or visits shown for each category of Extended Care Expense on your Schedule of Coverage. Previous: ← Business income (without extra expense) coverage form. You see the healthcare provider and get a prescription. Calendar Year Deductible Example 2024.

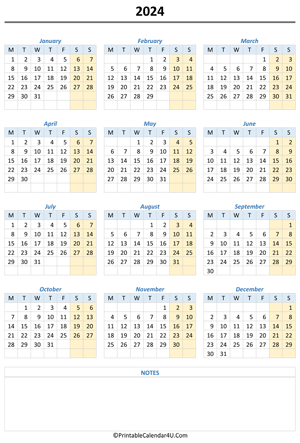

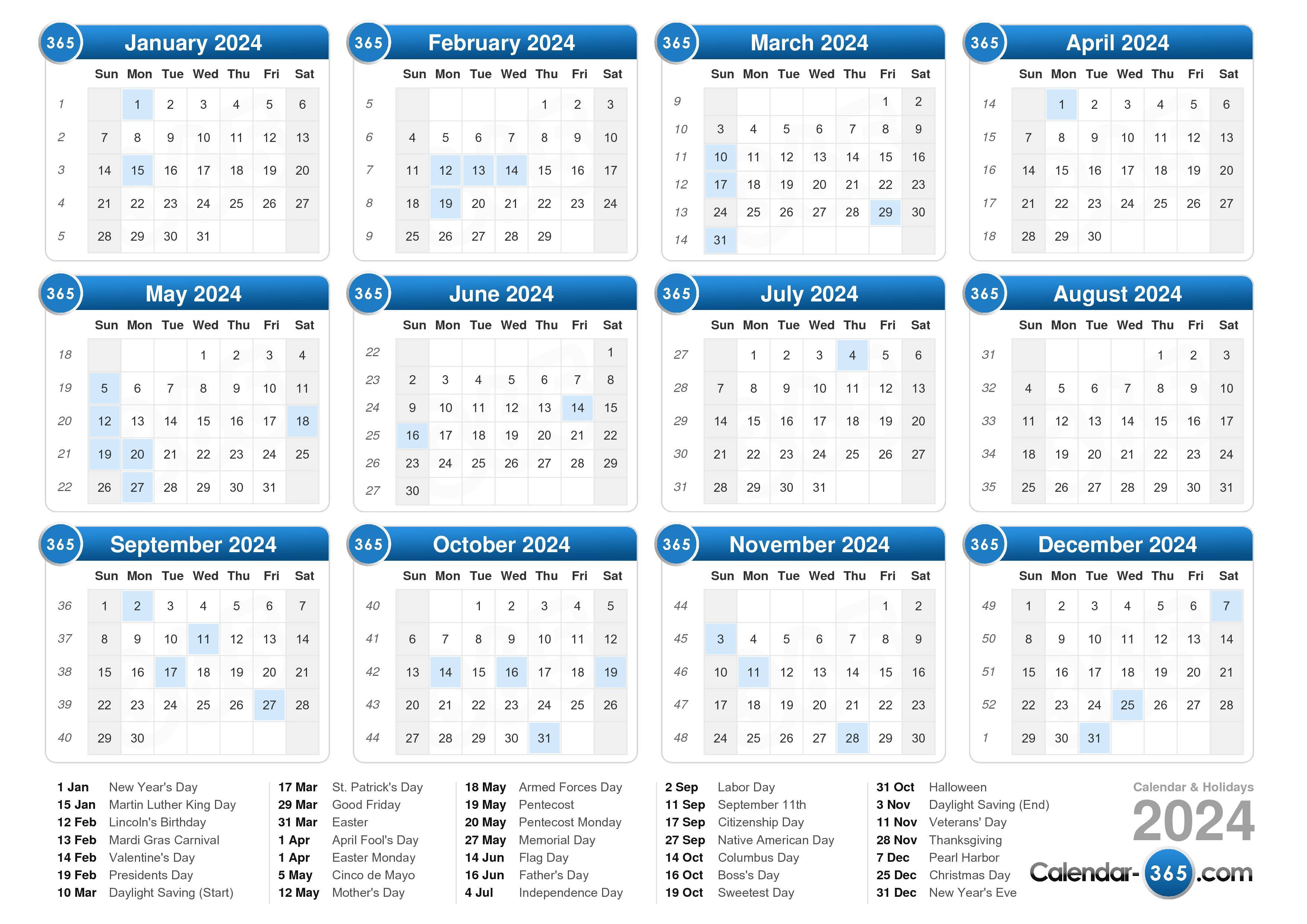

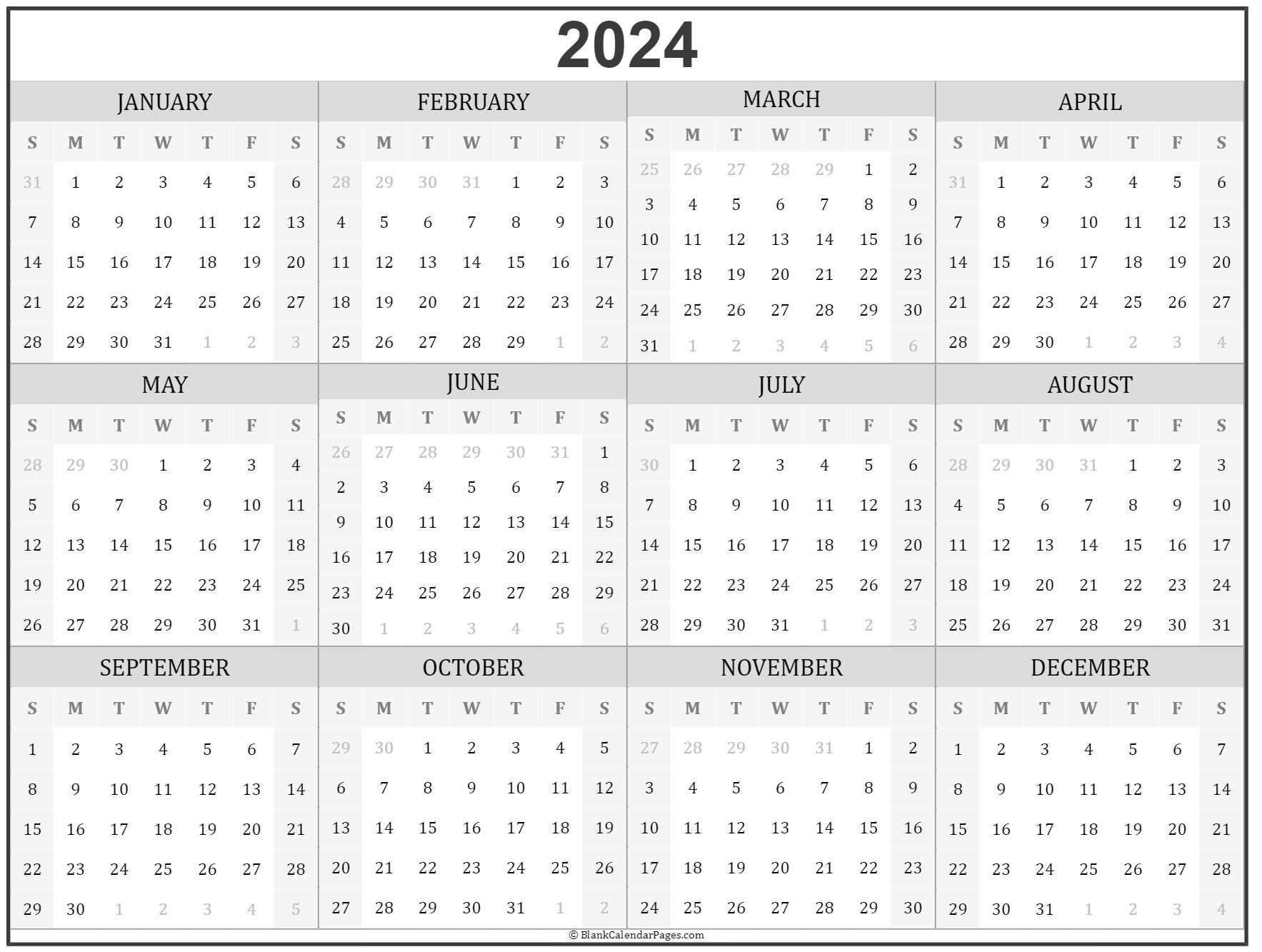

Visit this page on your Smartphone or tablet, so you can view the Online Tax Calendar on your mobile device.

A dental insurance deductible is the dollar amount you must pay for covered dental services before your dental plan starts to pay.

Calendar Year Deductible Example 2024. Previous: ← Business income (without extra expense) coverage form. Online Tax Calendar View due dates and actions for each month. A plan year deductible resets on the renewal date of your company's plan. Carrier may specify this in contracts. For Plans with a Calendar Year Deductible, the De- ductible applies to all Covered Services and supplies furnished by Participating and Non -Participating Den- tists, except as specified in the Summary of Benefits which is attached to and made a part of this EOC.

Calendar Year Deductible Example 2024.