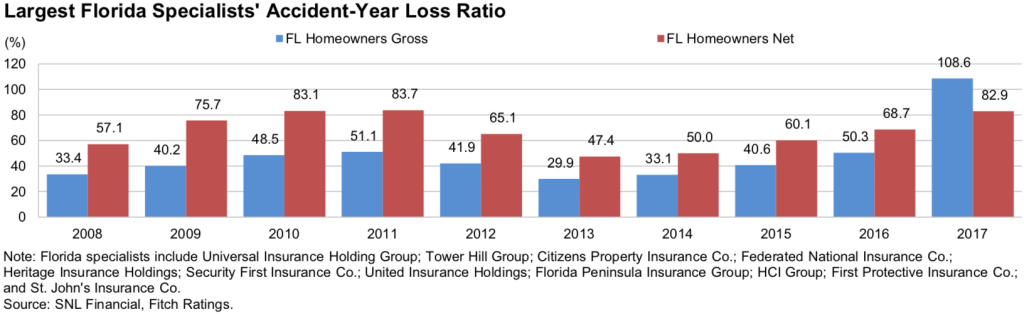

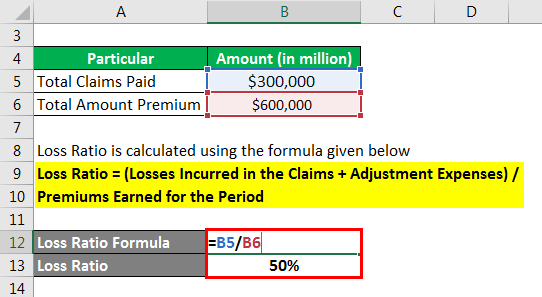

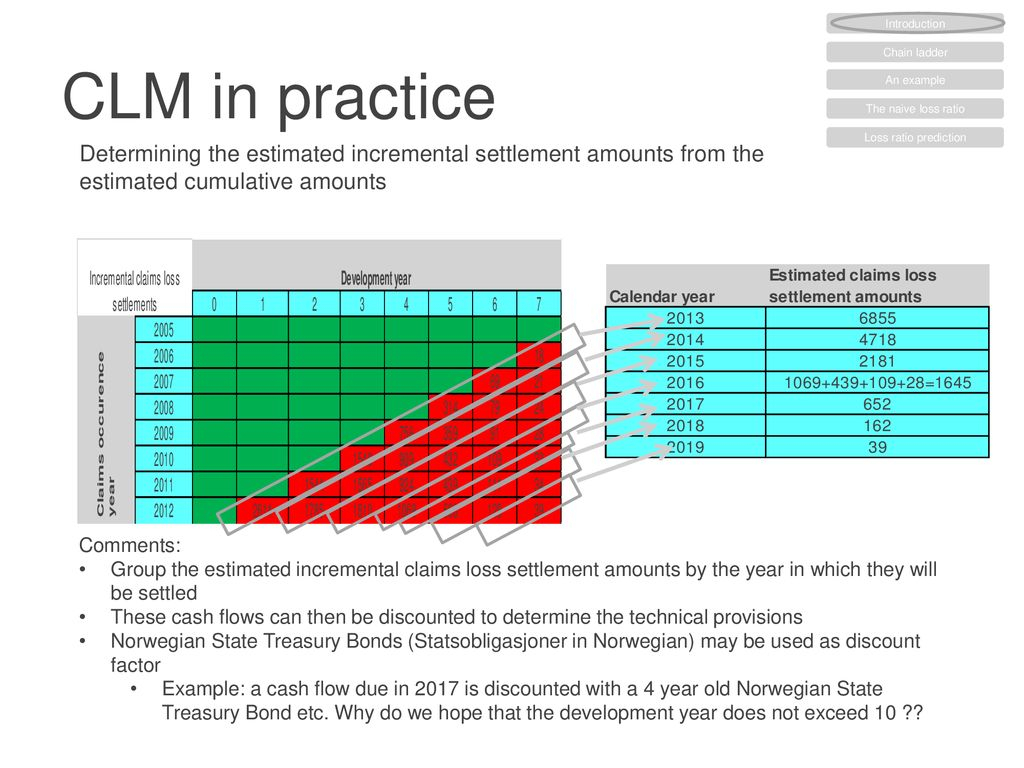

Calendar Year Loss Ratio Definition 2024. Calendar-accident year experience provides more recent results, but when compared to policy year experience, the calendar-accident year premiums are not as perfectly matched to losses, because audits and retrospective rating adjustments on prior-year policies are reported in the year they are made." Loss ratio is the losses an insurer incurs due to paid claims as a percentage of premiums earned. In many countries, the insurance industry is in the process of establishing. They are the standard calendar year loss ratio and the calendar year loss ratio by policy year contribution. Policy Year – these terms refer to methods of organizing insurance data. This can distort the triangle such that reserving methods like chain ladder or the loss ratio method do not work properly. Understanding what each involves can help you determine which to use for accounting or tax purposes. It represents the portion of the net premium that is left after benefit costs and operating expenses are paid. A high loss ratio can be an indicator of financial distress, especially for a property or.

Calendar Year Loss Ratio Definition 2024. Calendar year accounting incurred losses refer to any amount of money an insurance company either pays or can no longer count as an asset on its books. Policies Adopted as Described As in past years, policies in the Advance Notice that are not modified or retracted in the Rate Announcement become effective for the upcoming payment year. Calendar Year Experience = Accounting Earned Premium / Incurred Losses and Loss Adjustment Expenses (LAE), the cost associated with investigating and settling an insurance claim, for all losses. However, many factors can create dependencies between the three directions and is assumption. In many countries, the insurance industry is in the process of establishing. Calendar Year Loss Ratio Definition 2024.

Most reserving methodologies assume that the AY and DY directions are independent.

A high loss ratio can be an indicator of financial distress, especially for a property or.

Calendar Year Loss Ratio Definition 2024. Two basic methods exist for calculating calendar year loss ratios. When the loss data is summarized in a triangular format, it can be analyzed from three directions: accident year (AY), development year (DY), and payment/calendar year (CY). Medicare Shared Savings Program (Shared Savings Program) ACOs are groups of doctors, hospitals, and other health care providers who collaborate to give coordinated high-quality care to people with Medicare, focusing on delivering the right care at the right time, while avoiding unnecessary services and medical errors. It represents the portion of the net premium that is left after benefit costs and operating expenses are paid. They are the standard calendar year loss ratio and the calendar year loss ratio by policy year contribution.

Calendar Year Loss Ratio Definition 2024.